By Erika Bright, Partner, Wick Phillips Insurance Recovery Group

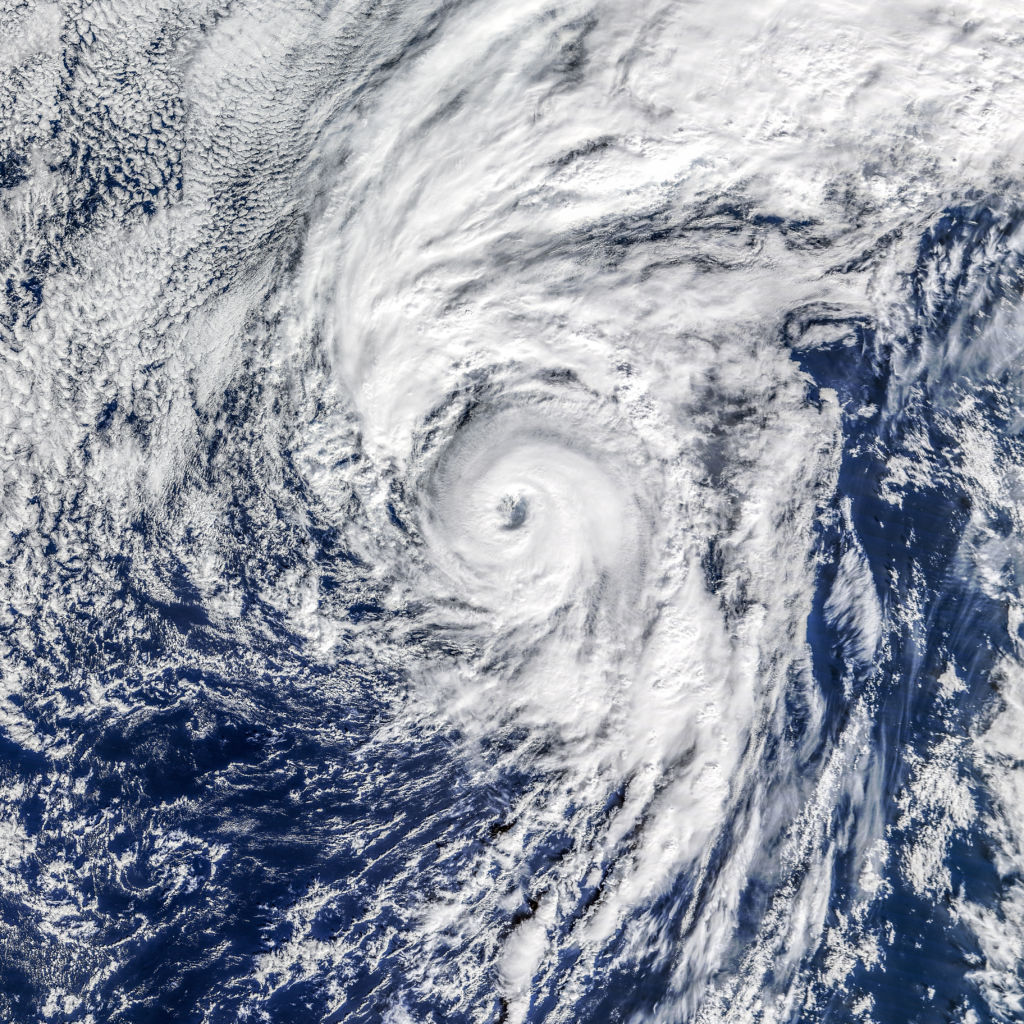

The 2020 hurricane season threatens to exhaust the alphabet. With destruction and property claims predicted to reach new records, insureds with property losses should keep these key points in mind from the outset to maximize your insurance recovery:

1. Promptly notify your broker and insurance carrier. Be sure to notify your carrier as quickly as possible after the loss. Take care to comply with each policy’s specific notice requirements. Involve your broker in the process.

2. Involve your insurance carrier from the outset. Whenever possible, include your carrier in your repair/replacement/debris removal efforts and obtain its approval beforehand. Be aware that your carrier may have rights to salvage certain property.

3. Satisfy policy timing and mitigation requirements. Familiarize yourself with any timing requirements set out in the policy, such as any Proof of Loss deadline. If you are not able to reasonably satisfy a deadline, communicate with your carrier beforehand and request a written extension. Do the best you reasonably can to mitigate further loss. Keep your carrier informed in real-time as much as possible.

4. Keep an open line of communication. Establish a rapport with your carrier. Document your communications. Be responsive to reasonable requests for information. If an information request seems out of line, try to address that with the carrier on the front end. Conduct or confirm your communications in writing when possible.

5. If you hire a Public Adjuster, do your diligence and have a clear contract. Make sure the Public Adjuster is licensed. As with all professionals, check references carefully. Inquire about their claim adjusting and construction estimating skills, credentials and specific experience. Understand the fee contract. Most Public Adjusters work on contingency fees that range from 5% to 15% of the amounts that the insurance company pays on the claim. The fee payable to a Public Adjuster should take into account the complexity and status of the claim. Makes sure the agreement is clear as to whether the Public Adjuster will get a percentage of any amounts the insurance company has already agreed in writing to pay but has not actually paid. If you want the Public Adjuster to handle/recover on only certain parts of your claim, specify that in the agreement.

6. Review your insurance coverage. Be aware of all potential coverages that may be available to your business. Property policies vary, but they can include protection for many types of costs, such as: physical damage, loss of use, business interruption, contingent business interruption, debris removal, security costs, consultant costs, soft costs, code upgrades, etc.

7. Keep detailed records. Track and document all costs (internal and external) in writing. Summarize and organize the records by category where possible and include all back-up. Submit the documentation of your costs to the carrier on a continual basis. Keep a clear record of what you send to your carrier.

8. Properly prepare your Business Interruption/Extra Expense claim. These claims typically involve large dollar amounts and require assistance from professionals who are experienced in this specific area. Understanding the policy and presenting the claim effectively from the start will be key to maximizing these coverages and expediting payment.

9. Examine denials or reductions of your claim. If your carrier denies your claim in whole or in part, enforce your right to a written denial that includes the carrier’s explanation. If you question the carrier’s denial or reduction of your claim, consider involving coverage counsel to analyze the carrier’s position.

About Wick Phillips’ Insurance Coverage Practice

The attorneys in Wick Phillips’ Insurance Coverage Practice have decades of experience representing corporate policyholder clients in major insurance coverage matters. Our insurance team advises on every step of the claims process and dispute resolution with insurance carriers. To learn more about the practice, click here.

View PDF